Buying a term insurance for a housewife? Know what to consider beforehand!

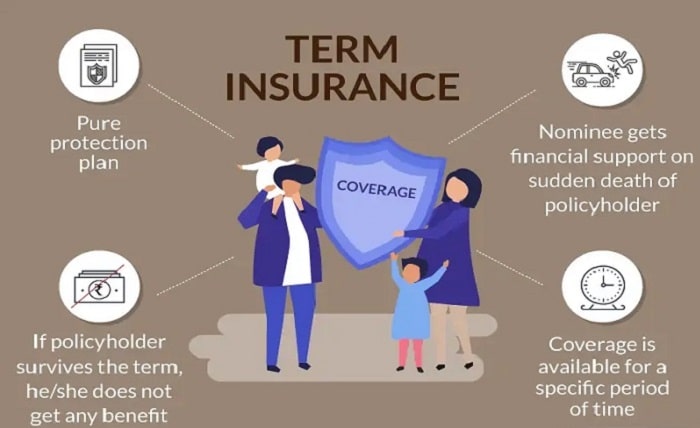

Just like everyone present in the house, your wife also requires the term insurance irrespective of the fact she is working in an organization or not. Housewives have a critical role in supporting and nurturing the family’s health. Even though they do not get paid directly, their contributions are substantial and should not be overlooked when thinking about financial stability. As a breadwinner of the house, it is critical to make sure women have adequate life insurance coverage to safeguard the financial security of the family and the right term life insurance plan can help you achieve that.

Why should you think about getting term life insurance for women?

The majority of us rely on the support and care provided by women. In spite of not having a formal source of income, they play a crucial role in running the household and raising the kids. Following are the reasons why you need to ponder about getting term life for your wife:

Provides them with financial safety: Since life insurance acts as a safety net for the family’s finances, housewives need it as much as any other member of the house. In case of the unfortunate demise of the policyholder, the life insurance payout provides the surviving family members with much-needed financial support. It ensures they will not face undue hardship in maintaining their standard of living and meeting their financial obligations, including paying their bills.

Unpaid Contributions: Housewives contribute a significant amount of unrecognized financial contributions. Their role in taking care of the house, providing emotional support, and tending to young children and elderly family members has a significant financial worth. By acquiring term insurance for housewife, their contributions are acknowledged and protected, ensuring that their worth is upheld.

Debt Coverage: Unpaid loan, credit card debt, and loans are common among families. In the absence of the housewife, surviving family members can find it challenging to meet these financial obligations on a single-pay cheque. With the aid of death benefits from the term insurance for housewife, these debts can be settled, saving the family additional anxiety and strain during a difficult period.

Future Planning: For housewives, a term life insurance plan is an essential part of their long-term financial strategy. It could be a source of funding for significant life goals like career advancement or a child’s schooling. The life insurance payout can help secure the family’s future and allow them to meet their financial objectives even in the event that she is not unfortunately present.

Peace of Mind: Having a term life insurance plan gives the homemaker and the family peace of mind. It is reassuring to know that you have a safety net of finances in case things get tough. She is able to focus on her health since she knows that her loved ones will be financially taken care of in an emergency.

What should you think before selecting the term life insurance for a housewife?

The following ten considerations should be made when choosing term insurance for a housewife:

Assess the monetary contribution she makes: Homemakers still have a lot of unpaid work to do, such as taking care of the family, keeping the house clean, and providing for others, even though they do not have a formal paycheque. Think about the monetary value of these contributions and how the family’s ability to make ends meet would be impacted by their absence. Select the best term insurance policy that covers these insignificant but significant contributions by evaluating the cost.

Adjust the Level of Coverage: Select a level of coverage that fits the requirements and long-term goals of the family. Analyze your current debts, living expenses, college costs, and projected medical costs. Thanks to the customized coverage, the family will be adequately protected in the event of an awful situation.

Understand the riders and select the one: Examine insurance riders and add-ons that can increase the coverage provided by the policy. Riders like critical illness riders, accidental death benefit riders, or waiver of premium riders may provide further protection to address the needs and potential risks faced by housewives.

Take into the Health Concerns and Insurance: Understand how the housewife’s health problems could impact her need for coverage. Certain medical issues may lead to premium increases or exclusions. Get the best term insurance for housewife by working with an insurance agent, regardless of any pre-existing conditions.

Compare Several Quotes: Get quotes from many insurance providers to compare premiums, benefits, and coverage options before selecting the term life insurance plan. This makes it possible for you to find the ideal term insurance plan that fits your budget and your family’s specific requirements.

Forecasting inflation: Consider inflation when determining the coverage amount for term insurance for housewife. Future expenses must to be taken into account, and the insurance ought to guarantee that the family can maintain a comfortable standard of living even in the face of rising costs.

So, at last

Women need to choose the right life insurance policy to protect the financial future of the entire family. As a breadwinner, one has to understand that housewives make a variety of contributions to society, and we can recognize their hard work and provide them with the safety and comfort they need by providing comprehensive term life insurance plan. Take into consideration their invaluable efforts and their unpaid care and household management responsibilities. It is essential to adjust the coverage amount to the household’s needs. It is easy to choose the best policy that offers comprehensive coverage at a reasonable cost by comparing quotes from reliable insurers. You may provide your loved ones with peace of mind, knowing that they will be financially secure no matter what the future holds, by protecting the homemaker’s financial future.