Chase Business Credit Card: Guide for Entrepreneurs

Chase offers a variety of business credit cards designed to meet the unique needs of entrepreneurs, freelancers, and small business owners. The Chase business credit card portfolio includes cards with cash back, travel rewards, and valuable perks that can make managing business expenses more rewarding and convenient. In this article, we will explore the different types of Chase business credit cards, their benefits, and key features to help you choose the right card for your business.

Why Choose a Chase Business Credit Card?

Choosing a Chase business credit card can provide numerous advantages for your business. With Chase, you get access to a wide range of benefits, including rewards on everyday purchases, travel perks, and expense management tools. Many Chase cards also offer no annual fees for employee cards, allowing you to extend benefits to your team. Additionally, Chase’s renowned customer service and fraud protection provide peace of mind, so you can focus on running your business with minimal financial distractions.

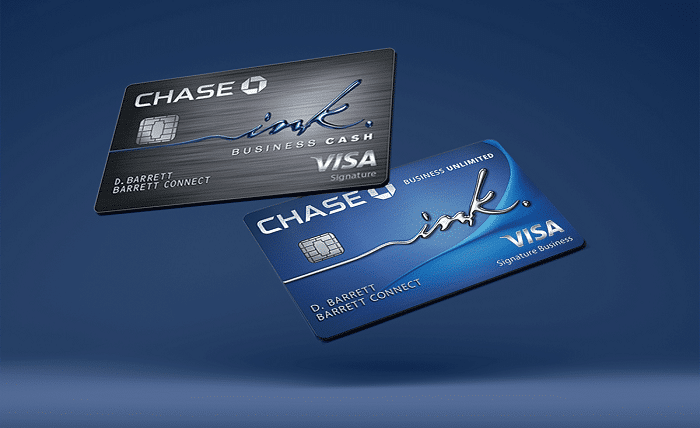

Types of Chase Business Credit Cards

Chase offers several business credit cards with unique features to suit various business needs. The most popular options include the Ink Business Cash® Credit Card, Ink Business Unlimited® Credit Card, and Ink Business Preferred® Credit Card. Each card comes with its own set of rewards and benefits, catering to businesses that prioritize cash back, unlimited rewards, or travel points. Understanding the different types of buiness time can help you choose one that aligns best with your business goals and spending habits.

Key Benefits of Chase Business Credit Cards

The Chase business credit card lineup is packed with benefits, from rewards on business expenses to travel perks. Cardholders can earn cash back on common business purchases, such as office supplies, internet services, and travel expenses. Additionally, many Chase business cards offer significant sign-up bonuses, which can boost your rewards balance early on. Access to exclusive offers and flexible redemption options also make the Chase business credit card a versatile choice for business owners.

Rewards Program for Chase Business Credit Cards

One of the biggest attractions of the Chase business credit card is the rewards program. With cards like the Ink Business Cash® and Ink Business Unlimited®, business owners can earn valuable cash back on every purchase. Alternatively, the Ink Business Preferred® Credit Card offers points on travel and select business categories, making it ideal for those who frequently travel or have diverse spending needs. The Chase business credit card rewards program allows you to redeem points for travel, cash back, gift cards, and more.

Travel Perks and Protection with Chase Business Credit Cards

If you or your employees travel frequently for work, a Chase business credit card can offer extensive travel perks. Cards like the Ink Business Preferred® provide benefits such as travel insurance, trip cancellation/interruption coverage, and no foreign transaction fees. Chase business cards also include rental car insurance and access to travel rewards, making it easier and more affordable to manage business trips. The Chase business credit card travel perks make it an appealing choice for businesses on the go.

Expense Management Tools for Business Owners

Managing business expenses is crucial for long-term financial health. The Chase business credit card comes equipped with various expense management tools to help business owners track and categorize spending. Features like itemized billing statements, spending reports, and integration with accounting software provide clear visibility into business finances. Chase’s online and mobile platforms also make it easy to monitor employee spending, set spending limits, and control expenses, making the Chase business credit card a powerful tool for managing cash flow.

How to Apply for a Chase Business Credit Card

Applying for a Chase business credit card is a straightforward process, but there are a few key factors to consider. Chase evaluates both your business and personal credit, so it’s essential to have a good credit history. You’ll need to provide details about your business, such as annual revenue and industry type, as well as your tax identification number. Understanding Chase’s application requirements and preparing relevant documents can improve your chances of approval for a Chase business credit card.

Eligibility Requirements for a Chase Business Credit Card

To qualify for a Chase business credit card, applicants typically need to meet certain requirements, such as having an established business, even if it’s a small-scale or sole proprietorship. Chase considers various factors, including your business credit history, revenue, and industry. Additionally, your personal credit score will play a role in the approval process. Understanding the eligibility requirements for a Chase business credit card can help you better prepare for the application and improve your chances of approval.

Maximizing Rewards with a Chase Business Credit Card

A Chase business credit card can be a valuable asset if used strategically. By maximizing rewards, you can turn everyday business expenses into points or cash back. For instance, using your card for purchases in categories that offer the highest rewards rate, such as office supplies or travel, can significantly boost your rewards balance. Additionally, keeping track of promotional offers and redeeming points for high-value rewards, like travel or gift cards, can further enhance the value of your Chase business credit card.

Conclusion

Choosing a Chase business credit card can be a game-changer for small business owners and entrepreneurs. With an array of cards offering different rewards structures, travel perks, and expense management tools, Chase makes it easy to find a card that aligns with your business’s needs. Whether you’re looking to earn cash back on everyday expenses or need a reliable card for frequent travel, the Chase business credit card lineup provides flexible and rewarding options. Take the time to compare your options and select a card that best supports your business goals.

FAQs

1. What are the most popular Chase business credit cards?

The most popular Chase business credit cards include the Ink Business Cash®, Ink Business Unlimited®, and Ink Business Preferred® Credit Card. Each card offers unique benefits tailored to different spending needs, from cash back to travel rewards.

2. Can I apply for a Chase business credit card if I’m a sole proprietor?

Yes, sole proprietors can apply for a Chase business credit card. Chase considers applicants from various business types, including sole proprietors and small-scale businesses, as long as they meet the eligibility requirements.

3. Is there a fee for additional employee cards?

Most Chase business credit cards offer employee cards at no additional cost, allowing you to extend benefits to your team members while managing expenses through a single account.

4. How can I maximize rewards on my Chase business credit card?

You can maximize rewards by using your Chase business credit card for purchases in high-reward categories and taking advantage of promotional offers. Redeeming points for high-value options like travel or cash back can also boost the value of your rewards.