Features of a Good Term Insurance Plan

Are you considering term insurance to secure your family’s financial future? Do you want to know what makes a term insurance plan beneficial? In India, where financial stability for family members is vital, adequate term insurance coverage may make all the difference. Understanding the key aspects might help you make an educated decision when acquiring term insurance for 2 crores or any other amount. Let’s look at the key elements that define strong-term life insurance coverage.

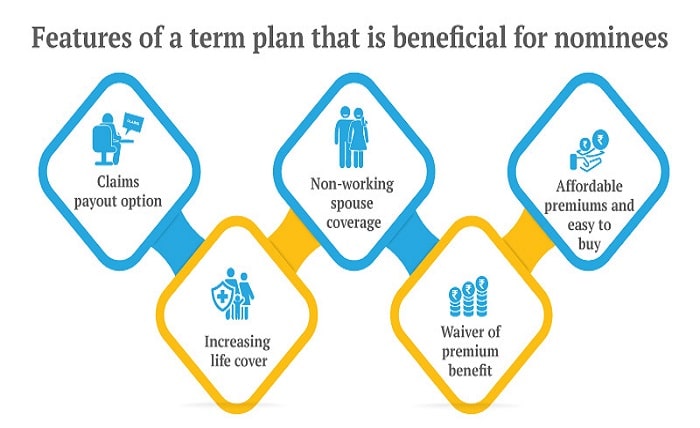

Affordable premiums

A good term insurance plan should have low premium rates. This makes it possible for policyholders to continue with their policies without straining their financial muscles. The majority of the insurers provide reasonable rates for a 2-crore term insurance policy in India, making it accessible to many people.

High sum assured

The amount of sum assured is one of the most crucial components of a term insurance plan. A good plan should offer a high sum assured to enable your family to meet their financial needs upon your demise. For instance, a term insurance 2 crore policy provides a massive amount to ensure that your family does not have to alter their way of life or have to let go of their aspirations.

Flexible policy terms

Policy flexibility is therefore important. A perfect term life insurance policy should allow you to choose the duration of the policy about your requirements and obligations. The policy terms in India may range from 10 to 40 years which is enough to select what will be appropriate.

Riders and add-ons

In addition to the above features, a good term insurance plan should include the following riders and add-ons. A few of the most popular riders are critical illness, accidental death, and the waiver of premium. These additional covers complement the package to ensure that your family is completely shielded from any financial loss.

Easy claim settlement

The ability to easily settle claims is another advantage. When selecting a term insurance plan, simplicity and ease of the claim process should also be factored in. Insurance companies with high claim settlement ratios are preferred in India as it is believed that such insurance companies are more trustworthy.

Tax benefits

A term life insurance policy should qualify for tax exemptions under Section 80C and Section 10 (10D) of the Income Tax Act of 1961. This makes the policy cheap to the policyholder and the policyholder can also save on taxes while at the same time ensuring the future of his or her family.

Option for increasing cover

A good term insurance plan should enable the policyholder to add more coverage based on certain milestones such as marriage or birth of a child. This helps to ensure that the coverage is still adequate as your liabilities grow over time.

Premium payment flexibility

Flexibility in premium payment is another important feature. Therefore, a good term insurance should offer several options of payment such as annual, half-yearly, quarterly or monthly. This makes it easier for the policyholders to select a payment plan that they would wish to undertake.

Return of premium option

There is ROP in some term insurance plans where the paid premiums are returned if the policyholder survives the policy term. While this feature can increase the premium, it comes with an assurance that the amount paid is not going up in smoke.

Online purchase and management

A good term insurance plan should also be easy to purchase and maintain online. This not only saves time but also brings convenience to the policyholders since they can attend to their policies from the comfort of their homes.

Grace period for premium payment

Another advantage is the relatively long grace period for premium payment. This allows the policyholder to go on with the policy even if he or she is unable to pay the premium on the stipulated date.

Non-smoker benefits

It is common for insurance companies to set relatively low premiums for non-smokers because they are not as vulnerable to severe diseases. It should also make a cash payment when the policyholder has been diagnosed with a terminal illness since this is a time when money is important.

Coverage for terminal illness

Some term insurance plans allow the addition of spousal coverage. This feature ensures that both the husband and the wife are covered under one policy making it easier for the family.

Spousal coverage

The best term insurance plan should allow policyholders to convert the policy into a permanent policy like whole life insurance without going through the rigorous underwriting process. This is convenient because your financial needs vary depending on the stage of life you are in.

Convertible policies

To offset the eroding effect of inflation, some term insurance plans are offered with inflation protection where the sum insured increases annually. This aids in ensuring that there is enough coverage as time goes by.

Inflation protection

To offset the diluting effect of inflation, some term insurance plans come with inflation protection where the sum assured rises each year. This ensures that the coverage is always adequate in the future.

Customisable payout options

A good term insurance plan should therefore have flexible payout options. Whether you opt for the money to be paid out at once or in a sequence for some time, this implies that your family requirements are met most appropriately.

Worldwide coverage

For those whose work requires frequent business trips or who reside in different countries, global service is appreciated. The best term insurance plan should be able to provide coverage irrespective of the geographical location of the policyholder and therefore should provide worldwide coverage.

No medical exam policies

Some insurance companies offer term insurance policies where the policyholder does not need to undergo any medical tests. These might be slightly expensive, but they provide people with a one-stop shop where they can get covered as soon as possible.

Strong customer support

The best-term insurance plan should be backed by good customer service. Policy-related queries, claims, and other services should be easily accessible to customers.

Ending note

A good term insurance plan in India is cheap, offers a large amount of coverage, and flexible payout options, and comes with several benefits such as optional add-ons, tax exemptions, and hassle-free claim processing. While buying term insurance, especially a huge term insurance 2 crore plan, these factors need to be considered to provide complete financial protection to your dependents. Getting it right today may safeguard your family’s tomorrow; providing the much-needed relief and financial security.