How Do Stock Splits and Reverse Stock Splits Affect Share Prices?

Introduction

Hey there, fellow investors! Ever heard of stock splits and reverse stock splits and wondered what they mean for your investments? You’re in the right place. Understanding these concepts is crucial, especially if you’re keen on making informed decisions in the share market. Whether you’re monitoring the performance of individual stocks or tracking the Adani Power share price, knowing how stock splits and reverse stock splits work can provide valuable insights. Let’s break it down and explore how these corporate actions impact share prices and your investment portfolio.

What is a Stock Split?

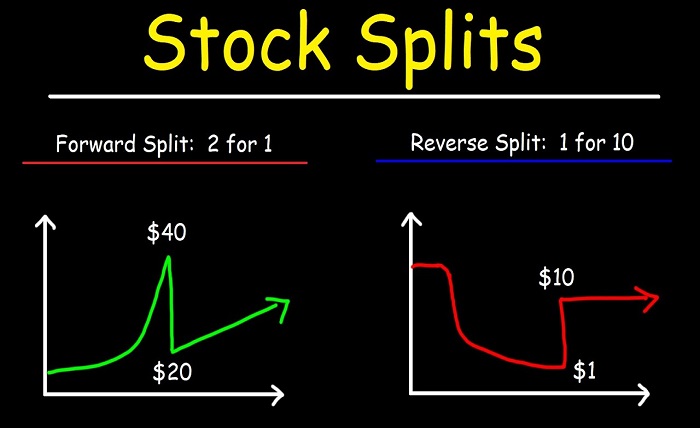

A stocks split occurs when a company decides to divide its existing shares into multiple new shares. While the number of shares increases, the total value of the shares remains the same. Think of it as exchanging a $20 bill for two $10 bills; the total amount of money you have doesn’t change, but you now have more bills.

Why Companies Perform Stock Splits

- Improved Liquidity: More shares in circulation can make trading easier and more fluid.

- Increased Affordability: Lower share prices make the stock more accessible to a broader range of investors.

- Market Perception: A stock split can be seen as a positive signal, suggesting that the company expects future growth.

Example of a Stock Split

Let’s say you own 100 shares of a company trading at $100 each. The company announces a 2-for-1 stock split. After the split, you’ll own 200 shares, but each share will now be worth $50. The total value of your investment remains $10,000.

Impact on Share Prices

1. Initial Drop in Share Price

-

- What Happens: The share price is adjusted downward based on the split ratio.

- Example: If Adani Power announces a 3-for-1 stock split and the pre-split share price is INR 900, the post-split share price will be INR 300.

2. Improved Market Perception

-

- What Happens: Stock splits can attract positive attention, leading to increased demand.

- Example: Post-split, more investors might find Adani Power shares affordable, potentially driving up the share price.

3. Increased Trading Volume

-

- What Happens: More shares in circulation can lead to higher trading volumes.

- Example: Higher liquidity in Adani Power shares might make it easier for investors to buy and sell.

What is a Reverse Stock Split?

A reverse stock split is the opposite of a stock split. It consolidates multiple existing shares into fewer shares. While the number of shares decreases, the total value of the shares remains unchanged. Think of it as exchanging two $10 bills for a $20 bill.

Why Companies Perform Reverse Stock Splits

- Compliance: To meet stock exchange listing requirements that often have minimum share price criteria.

- Market Perception: To improve the perception of the stock, especially if the share price has been declining.

- Attract Institutional Investors: Higher share prices can attract institutional investors who may have minimum price thresholds for investment.

Example of a Reverse Stock Split

Suppose you own 200 shares of a company trading at $5 each. The company announces a 1-for-4 reverse stock split. After the reverse split, you’ll own 50 shares, but each share will now be worth $20. The total value of your investment remains $1,000.

Impact on Share Prices

1. Initial Increase in Share Price

-

- What Happens: The share price is adjusted upward based on the reverse split ratio.

- Example: If Adani Power announces a 1-for-2 reverse stock split and the pre-split share price is INR 100, the post-split share price will be INR 200.

2. Market Perception

-

- What Happens: Reverse splits can sometimes be viewed negatively, as they may signal financial distress.

- Example: If Adani Power executes a reverse split, investors might interpret it as a move to boost the stock price artificially, leading to skepticism.

3. Reduced Trading Volume

-

- What Happens: Fewer shares in circulation can lead to lower trading volumes.

- Example: Post-reverse split, trading Adani Power shares might become less fluid.

Pros and Cons of Stock Splits and Reverse Stock Splits

Pros of Stock Splits

- Increased Affordability: Lower share prices make the stock accessible to more investors.

- Improved Liquidity: More shares in circulation can make trading smoother.

- Positive Market Perception: Often seen as a sign of confidence in the company’s future growth.

Cons of Stock Splits

- No Real Value Change: The overall value of the investment doesn’t change.

- Possible Overvaluation: May lead to speculative buying and overvaluation.

Pros of Reverse Stock Splits

- Meeting Listing Requirements: Helps maintain compliance with stock exchange listing criteria.

- Enhanced Market Perception: Can improve the perceived stability of the stock.

Cons of Reverse Stock Splits

- Negative Market Perception: Can be seen as a sign of trouble, leading to skepticism.

- Reduced Liquidity: Fewer shares in circulation can make trading less fluid.

Real-World Impact

1. Stock Split Example

-

- Scenario: Apple Inc. has a history of stock splits. Its most recent split was a 4-for-1 split in 2020.

- Outcome: The split lowered the share price, making Apple shares more affordable and potentially increasing demand.

2. Reverse Stock Split Example

-

- Scenario: Citigroup performed a 1-for-10 reverse stock split in 2011.

- Outcome: The reverse split increased the share price from about $4.50 to approximately $45, helping the company meet listing requirements and improve market perception.

Adani Power Share Price Context

Let’s apply this to the Adani Power share price. If Adani Power were to announce a stock split, the lower share price might attract more investors, potentially boosting demand and liquidity. Conversely, if Adani Power were to execute a reverse stock split, the higher share price might help it meet specific listing requirements or attract institutional investors, though it could also raise concerns about the company’s financial health.

Conclusion

Stock splits and reverse stock splits are significant corporate actions that can impact share prices and investor perception. While stock splits generally make shares more affordable and liquid, reverse stock splits can help companies meet listing requirements and improve market perception, though they might also signal financial distress. As an investor, understanding these mechanisms can help you navigate the share market more effectively, whether you’re monitoring general stocks or keeping a close eye on the Adani Power share price. Stay informed, stay savvy, and happy investing!